How Long Do Legals Take when Moving House in the UK?

Instant calculator + full guide to UK property transaction times

Average data from our recent files

Last updated 3rd November 2025

Get your personalised timeline estimate based on real data in less than 30 seconds

Learn what impacts on property transaction times and what the latest industry information is showing

Last Updated 3rd November 2025

Contents

-

- How long are completions taking right now?

- Our Ultimate Conveyancing Timeline Calculator

- How long does Conveyancing take in the UK? – A brief note from our Head of Residential Conveyancing

- How long does a purchase transaction take in 2025?

- Are property transactions taking longer?

- What influences the conveyancing timeline?

- How many cases does a typical conveyancer manage?

- What can you do to speed up conveyancing?

- Step-by-Step Conveyancing Summary

How Long Does Conveyancing Take in the UK?

Many conveyancers still quote the familiar “8–12 week” timeline — but for most buyers and sellers today, that’s simply unrealistic. Industry data shows that average purchases now take around 17 weeks, while sales can push towards 23 weeks. Compared with 2007, that’s an increase of 60% for purchases and 88% for sales. As it stands in 2025, the timelines are extending again, so unfortunately your move may take longer than you think.

At OCG Legal, our own figures show we consistently outperform the national averages, but more importantly we believe clients deserve to know the reality: most of our transactions now take 14–20 weeks, and some stretch longer. Only around 15% of our purchase cases complete in less than 8 weeks.

That’s why we’ve built the Conveyancing Timeline Calculator — giving you a tailored estimate based on your circumstances and the latest market conditions, rather than outdated rules of thumb.

The good news is that with proactive conveyancing, timelines can often be shortened.

Staying constantly on top of the chain does require extra resource, which is why many solicitors offer it as a premium service. It is usually only necessary for clients who want a super-speedy move, but it is something we can provide on a case-by-case basis where needed.

At OCG Legal we believe in providing great conveyancing for a fair fee and can provide a bespoke quote on request. Alternatively, generate an online quote based on our standard fees here: Free Conveyancing Quote

“Most OCG Legal clients complete their purchase in around 14 weeks — faster than the national average of 17 weeks – but all buyers should prepare for the potential of longer transaction times”

How long does a purchase transaction take in 2025? Quick Snapshot based on our 2024-2025 data:

weeks minimum for 90% of our files

weeks or less for 1 in 4 of our files

weeks for our typical case

weeks is the National Average (2024)

weeks or less for 3 in 4 of our files

Conveyancing Timeline Calculator

"Probably the most comprehensive UK Conveyancing Purchase Timeline Calculator on the internet"

How long will it take to complete my property purchase in November 2025 once I instruct my conveyancer?*

weeks for completions in October 2025

weeks for completions in Sept. 2025

weeks for completions in August 2025

weeks for completions in July 2025

weeks for completions in June 2025

weeks for completions in May 2025

*Based on the typical purchase from our files. We believe in Real Data & Transparent Results.

As a small specialist firm (and not a factory conveyancing farm) outliers in any given month may from time to time impact the above figures quite substantially.

For a better idea of how long your conveyancing process may take, use our interactive conveyancing timeline calculator.

The above figures are from the date of instruction, include the initial onboarding time (2 weeks for the typical case) whilst we wait for buyers to provide us with their documentation.

Oh and yes, we’ll be able to answer the question of how long completions took in November 2025 early next month, so don’t forget to check back and find out how long our files took to complete in November 2025!

Are Property Transactions Taking Longer?

For years, the rule of thumb was that conveyancing took 8–12 weeks from instruction. In practice, it’s now much longer.

Industry data from Today’s Conveyancer shows:

- Purchases: 123 days in 2023, 120 days in 2024 (~17 weeks)

- Sales: 159 days in 2023, 160 days in 2024 (~23 weeks)

- Compared to 2007, that’s a 60% increase for purchases and an 88% increase for sales.

At OCG Legal, our experience reflects these extended timescales:

-

- Our typical purchase (median) now completes in 97 days (~14 weeks).

- Our average purchase (when you include the outliers) is 110 days (~16 Weeks), near the national average of 17 weeks.

- Around 1 in 4 purchases complete within 10 weeks, but almost 2 in 5 take longer than 15 weeks.

- Outliers exist, with our longest case completing in 2024/2025 taking 478 days (~15½ months)

The good news is that straightforward cases can still complete in 8 weeks or less, but this only applies to around 15% of purchases.

Takeaway:While the old rule of thumb was 8–12 weeks, both national data and our own files show that 16–20 weeks is increasingly realistic for many buyers and sellers in today’s market. If you’re planning a move, it’s wise to budget not only money but also time — assuming 4–5 months is far safer than hoping for a quick 2–3 month turnaround.

This illustration indicates how long purchase transactions take to complete with OCG Legal. The green line (median) represents the “typical” case at 97 days (around 14 weeks), while the blue line (average) sits slightly higher at 110 days (16 weeks), reflecting the impact of longer outliers. The red line (national average) at 120 days (17 weeks) highlights that OCG Legal transactions typically complete faster than the wider market.

What Influences the Conveyancing Timeline?

Every property transaction is different, and the time it takes to complete can vary widely. Several key factors influence whether your move is quick and straightforward, or drawn out. Here is a comprehensive but by no means exhaustive list of the factors that may speed up or slow down your property purchase:

-

Mortgage vs. cash – Cash buyers avoid the mortgage process, which can remove weeks of delay.

-

Property type – Leasehold transactions often take longer than freehold because of additional enquiries, landlord/managing agent packs, and service charge checks.

- Shared ownership — housing association approvals and detailed lease reviews often add 3–6 weeks.

-

Local authority search times – These vary by council, from just a few days to several weeks. Sometimes these get ‘lost’ and must be chased up.

-

Chain length – The more transactions linked together, the more coordination is needed — and any weak link can slow everyone down.

-

Buyer and seller readiness – Delays often happen when ID checks, forms, or supporting documents aren’t provided promptly.

-

Survey results – Issues uncovered in surveys can lead to renegotiations or further legal enquiries.

-

Third parties – Mortgage lenders, managing agents, landlords, or freeholders can all introduce delays.

- Drop Outs – parts of the chain falling through can lead to significant delays as new buyers are found. This can lead to opportunities for ‘cash buyers’ that are ready to act quickly to step in but may also lead to extra demands on the chain.

- Gifted deposits — extra anti–money laundering checks and proof-of-funds requirements can add 1–2 weeks.

- Help to Buy & Lifetime ISAs — administrative delays with providers can add 2–4 weeks.

- BSA lenders — not always covered by the UK Finance Handbook; extra checks can add 1–3 weeks.

- BSA documents — bespoke lender instructions and paperwork can add 2–4 weeks

- High-rise flats — extra Building Safety Act (BSA) checks and certificates can add 3–6 weeks.

-

Seasonal peaks – Summer holidays and Christmas regularly cause bottlenecks as home owners are away

- Solicitor holidays & seasonal closures – Even the most efficient conveyancer can’t progress matters when offices are closed or key people are away. Annual leave, bank holidays, and Christmas shutdowns can all add extra days or even weeks to a transaction. In particular, late August or early September completions often face delays of 1–2 weeks because so many solicitors, lenders, and estate agents are on holiday, while late December or early January completions can be delayed by 2–3 weeks due to Christmas and New Year office closures.

-

Proactivity of conveyancer – A proactive solicitor who chases the chain can shorten timescales, though this requires additional resource and is often offered as a premium service.

- Agreed Service Levels – Some solicitors or conveyancers offer a premium level service with better service level agreement (SLA) turnaround times

Gifted Deposits: Do They Delay the Process?

A gifted deposit is when part (or all) of the buyer’s deposit comes from a family member or another third party rather than their own savings. While perfectly acceptable, lenders and conveyancers must complete extra checks to ensure the gift is genuine, not a loan in disguise, and that anti–money laundering rules are satisfied.

This usually involves:

-

A signed gifted deposit letter (confirming no repayment is expected).

-

Proof of the donor’s funds (bank statements, source of wealth checks).

-

Sometimes ID and address verification of the donor.

Impact on timeline:

These extra checks can add 1–2 weeks if documentation is missing or the donor is slow to provide evidence. In straightforward cases, there is little to no delay — but in practice, this is often one of the most common “avoidable” slowdowns.

Leasehold Transactions: Why They Take Longer

Leasehold purchases are consistently slower than freehold. This is because extra enquiries must be raised with the freeholder or managing agent, and a management information pack (also known as the LPE1 form) is needed.

Common causes of delay include:

-

Slow responses from freeholders/managing agents when supplying packs (often taking 3–6 weeks).

-

Queries around ground rent, service charges, or planned works.

-

Additional approvals, such as Deeds of Covenant or Licences to Assign.

Impact on timeline:

Leasehold cases can easily add 4–8 weeks to the process compared with a similar freehold purchase.

Help to Buy & Lifetime ISAs: The Hidden Delays

Government schemes designed to help buyers — such as the now-closed Help to Buy equity loan or ongoing Lifetime ISAs — bring their own administrative delays.

-

Help to Buy equity loan: Requires separate approval from the scheme administrator before exchange and completion. Delays often arise because the administrators work to set turnaround times, not buyer deadlines.

-

Lifetime ISA: Withdrawals must be requested through your LISA provider. Some providers take up to 30 days to release funds, meaning solicitors cannot exchange until the money is guaranteed.

Impact on timeline:

Expect an additional 2–4 weeks on average, depending on the responsiveness of the scheme administrators and providers.

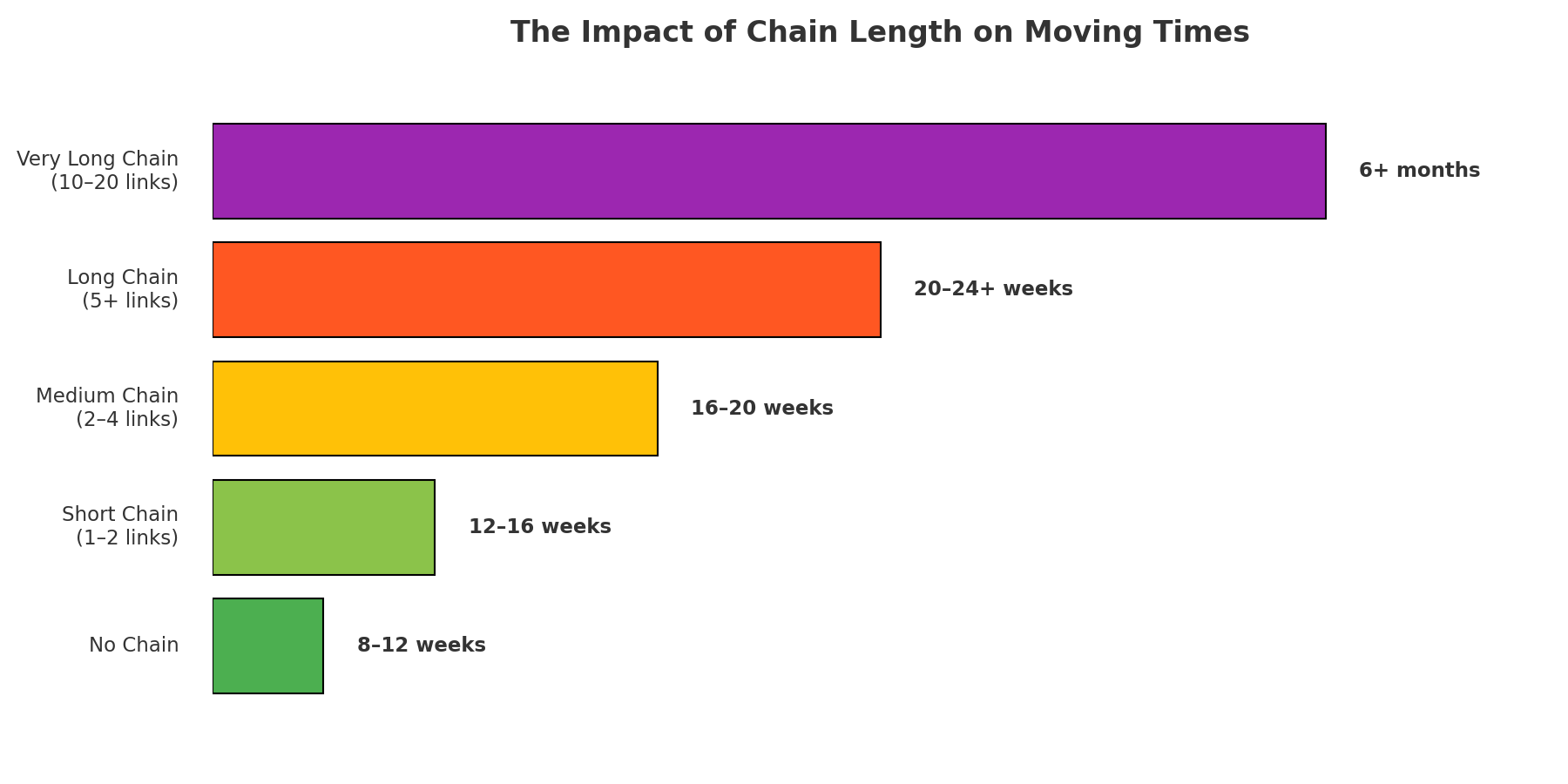

Property Chains: How They Affect Timelines

A “chain” exists when multiple sales and purchases are linked together, with each dependent on the next. The more links, the greater the chance of delay.

We’ve seen chains of up to 20 links, although 2–4 links is the most common range for UK property transactions.

How Chain Size Impacts Time

-

Simple chains (1–2 links): Often run close to the typical 12–16 week timescale.

-

2–4 links: The most common setup, usually manageable but still prone to delays if one party is slow.

-

Longer chains (4+ links): Can add an extra 4–6 weeks, sometimes more, depending on the weakest link.

Why Chains Are So Unpredictable

-

A single party’s survey issue, mortgage delay, or even a holiday absence can stall the entire chain.

-

Even with a proactive solicitor chasing constantly, your transaction is still exposed to the slowest party in the sequence.

-

Communication and cooperation across the whole chain are critical — and often outside any one buyer or seller’s control.

Impact on timeline:

Chains remain one of the most unpredictable elements in conveyancing. While most fall into the 2–4 link range and complete within 12–20 weeks, longer chains regularly stretch this out further.

The above chart is an educational illustration and does not mean that all transactions with the stated chain links will fall within the parameters above

BSA Lenders: Why They Take Longer

If your mortgage is with a Building Societies Association (BSA) lender rather than a high street bank, you may face extra delays. Not all BSA members are covered by the standard UK Finance Lenders’ Handbook, which sets out exactly what conveyancers need to do on behalf of the lender.

For non-handbook lenders, solicitors must seek specific instructions or additional documents for each case. This adds an extra step to the process. In some cases, the lender may even insist that you use one of a very small panel of solicitors, which can delay things further if your preferred firm isn’t approved.

Impact on timeline:

Expect an additional 1–3 weeks of delay if your lender requires bespoke instructions or isn’t part of the main UK Finance framework.

BSA Documents: More Paperwork, More Delay

If you are borrowing from a Building Societies Association (BSA) lender, your solicitor may need to review BSA-specific mortgage documents instead of (or in addition to) the standard UK Finance Handbook forms. These documents are often bespoke to the society, and they don’t always arrive quickly.

Solicitors must carefully check:

-

The lender’s unique requirements.

-

Any unusual conditions attached to the mortgage.

-

Whether separate approval from the lender’s legal department is required before exchange.

Delays arise because conveyancers can’t proceed until they’ve received and reviewed these documents. If the lender’s legal team has a backlog, this can add significant time.

Impact on timeline:

BSA-specific documents can add 2–4 weeks to a transaction, especially if the lender is slow to release instructions or insists on separate approvals.

High-Rise Buildings and the Building Safety Act

If you are buying a flat in a building over 18 metres (or 6 storeys), the conveyancing process often takes longer because of the Building Safety Act 2022.

Solicitors must check whether the building complies with new fire safety and cladding regulations. This involves reviewing additional documents such as:

-

The Building Safety Act (BSA) Certificate (where applicable).

-

Fire Risk Assessments and remediation plans.

-

Evidence of who will bear costs for any cladding or fire safety works.

Impact on timeline:

-

If the seller’s solicitor already holds the necessary BSA documents, the delay may be minimal.

-

If documents must be requested from freeholders, managing agents, or building owners, this can add 3–6 weeks (sometimes longer if disputes exist).

-

Some lenders will not release mortgage funds until the BSA checks are fully complete, meaning the entire chain can be held up.

What You Can Do to Speed Up Conveyancing

While some factors are outside your control, there are several practical steps you can take to help your transaction move faster:

-

Choose your solicitor early – Instruct a conveyancer as soon as you start looking for a property, not after your offer is accepted. This means ID checks and paperwork can be ready to go.

-

Get your documents in order – Have your photo ID, proof of address, bank statements, and source of funds documents ready. For sellers, make sure title deeds, planning permissions, warranties, and certificates are on hand.

-

Complete forms promptly – Buyers and sellers alike can lose weeks by delaying replies to standard forms and enquiries.

-

Stay mortgage-ready – If you need a mortgage, have your agreement in principle and lender documents prepared early.

-

Arrange your survey quickly – Booking your surveyor promptly avoids hold-ups further down the line.

-

Be responsive – Reply quickly to your conveyancer’s emails and calls; even small delays add up. Whilst…

-

Keep communication open – Stay in touch with your estate agent, solicitor, and (if you’re in a chain) the other parties to keep momentum going.

-

Consider a premium service – Some firms offer enhanced “chain chasing” and proactive management as a premium service for clients who want the fastest possible move.

How Searches can delay your move - or what we like to call the "Postcode Lottery"

Search times vary not only by local authority but also by the type of search. Official local authority searches are often slower, sometimes taking many weeks. Regulated ‘personal searches,’ carried out by providers such as SearchFlow, usually return results faster and are widely accepted by mortgage lenders.

Some councils return personal searches in just 1–3 working days, while others take 40+ days, and Hackney currently stands out at a whopping 180 working days!

Fastest personal search turnaround times (as of 2 Oct 2025):

-

Ashfield District Council – 1 working day

-

Babergh District Council – 1 working day

-

Calderdale Metropolitan Borough Council – 3 working days

-

Broxbourne Borough Council – 3 working days

-

Bassetlaw District Council – 3 working days

-

Basingstoke & Deane Borough Council – 3 working days

-

Chelmsford City Council – 3 working days

-

Cheltenham Borough Council – 3 working days

-

Chichester District Council – 3 working days

-

Chorley Borough Council – 4 working days

-

Bristol City Council – 4 working days

-

Burnley Borough Council – 4 working days

-

Blaby District Council – 4 working days

-

Blackpool Borough Council – 4 working days

-

Milton Keynes City Council – 4 working days

Slowest personal search turnaround times (as of 2 Oct 2025):

- Hackney London Borough Council – 180 working days

-

Breckland District Council – 40 working days

-

Carmarthenshire County Council – 40 working days

-

Newcastle-under-Lyme Borough Council – 45 working days

-

Newcastle upon Tyne City Council – 35 working days

-

Test Valley Borough Council – 35 working days

-

London Borough of Lewisham – 30 working days

-

London Borough of Waltham Forest – 30 working days

-

St Helens Metropolitan Borough Council – 30 working days

-

Teesdale District Council – 30 working days

-

Wear Valley District Council – 30 working days

-

Coventry City Council – 30 working days

-

Cyngor Gwynedd Council – 30 working days

-

West Northamptonshire Council (Daventry) – 30 working days

Remember that the type of search your require and the search provider can significantly impact the time to return searches. The above are typically based on ‘best case’ scenariors.

You can search for the most recent update for your council with search flow at https://www.searchflow.co.uk/news-and-events/personal-searches-turnaround-times/

How many cases does a typical conveyancer manage?

The number of active files a conveyancer manages can vary widely depending on the firm’s structure, level of administrative support, and the type of work undertaken. Most conveyancers in busy, high-volume firms are typically responsible for between 70 and 120 active files at any one time, and in some cases even more.

These higher volumes of up to 150+ cases tend to occur in large, panel-based or online firms that process transactions at scale, where case-handlers are often expected to achieve 20–25+ completions per month to meet operational targets. Mid-sized, service-focused firms generally aim for a more sustainable balance, with typical caseloads of 50–80 active files per conveyancer. Boutique or premium practices may reduce this further to 30–50 active files, allowing more hands-on service and proactive client communication.

At OCG Legal, we deliberately keep caseloads at a sustainable level to ensure quality and attention to detail. Each case-handler works alongside a dedicated assistant, enabling them to balance workflow efficiently and maintain direct engagement with clients and agents. On average, our case-handlers each work to 5–15+ completions per month, reflecting a manageable and consistent caseload that prioritises service excellence over volume.

This is why OCG Legal believes in quality conveyancing for a fair fee — delivering expert service and personal attention without compromising on value, so please don’t be put off by our reaonably low prices!

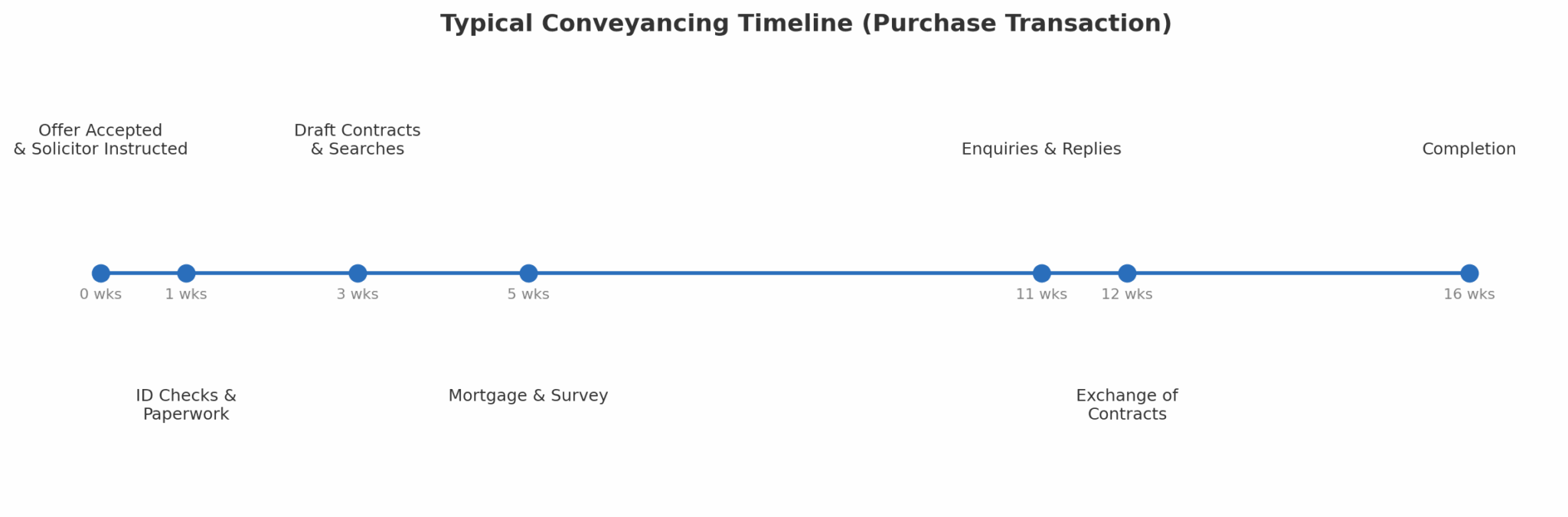

The Step-by-Step Conveyancing Process

Conveyancing begins the moment your offer is accepted and only ends when you finally have the keys in your hand. Although no two transactions are identical, most follow a similar journey.

Once your solicitor is instructed, the first few weeks are taken up with ID checks, initial paperwork and draft contracts. Sellers provide details about the property, while buyers’ solicitors prepare to order searches and review the contract pack. If you need a mortgage, this is also when your application should be submitted.

The next stage usually sees the draft contract pack exchanged between solicitors. For buyers, local authority, environmental and water searches are ordered at this point. These can take anywhere from a few days to several weeks depending on the council. At the same time, your lender is arranging a valuation and, if required, you will be booking your survey.

Once the searches are back and the survey or valuation is complete, the buyer’s solicitor raises enquiries — questions about the property, the title, or anything unusual that’s been flagged. This stage can be quick if everything is straightforward, or lengthy if information is missing, leasehold packs are slow to arrive, or issues are uncovered.

When all enquiries are satisfied, the mortgage offer is confirmed and both sides move towards signing and exchanging contracts. This is the point at which the deal becomes legally binding, a completion date is agreed, and deposits are transferred.

Finally, on the agreed day of completion, funds are transferred, keys are released, and the move officially takes place.

In an ideal world this whole journey could still be wrapped up in 8–12 weeks. In today’s market, though, it more often stretches to 16–20 weeks, with each stage having the potential to add delay if documents, searches, mortgage offers or chains are held up.