Latest Opinion Pieces, Blogs and

Content from our Team of Experts

Browse our helpful guides, covering everything from becoming an Executor, to creating your first Will.

Choose from our downloaded guides below on

Homeowners

Landlords

Estate Planning

Or visit our bank of articles, news and opinion pieces

Homeowners

Homeowners' Guide to Estate Planning

Everything you need to know to protect your new home

Homeowners' Legal Checklist

Everything you need to arrange after you get your keys

How to talk to your Parents about their Estate Plan

A guide to starting to conversation

Your Estate Overview

A practical guide to organising your assets and preparing your family for the future

Landlords

A Landlord's Estate Overview

A Practical Guide to Organising your Assets as a Landlord

Estate Planning FAQs

Everything you need to know about Estate Planning, including an FAQ and Glossary

Landlord's Guide to choosing an Executor

Will you be my Executor?

Estate Planning Services

What OCG Legal can provide

Wills, Probate and Estate Planning

Wills

Protect your legacy and provide for those you love

Probate

Probate; how it works, what it costs and how to navigate the process

Legacy Package

A guide to protecting your wishes and easing the burden on loved ones

Disputing a Will

Contentious Probate and Will Disputes

Articles and Blog Posts

How do you know if a Will is genuine or legal?

Contesting a Will can be a complex and emotional process, particularly when doubts arise about whether the document reflects the true intentions of the deceased. But how do you know if a Will is legally valid or even genuine? Recent case law, including Rea v Rea...

How Long Does Probate Take in the UK? Timeframes, Delays & What to Expect

Probate is the legal process of administering a deceased person’s estate… The length of time probate takes can vary significantly depending on the complexity of the estate, the efficiency of the executor, and whether any disputes arise during the process. Here’s a...

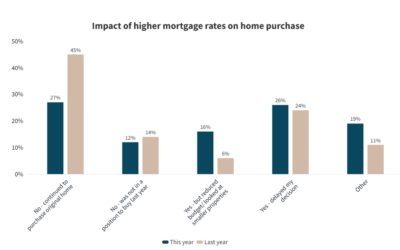

Buyers and Tenants Survey 2024

JLL (John Lang Lasalle IP, 2024) have recently released the results of their buyers and tenants survey, which looks at trends in the property market. At this volatile time, these trends may help landlords and investors to predict a fast-moving market. The results are...

What is the relationship between inflation, interest rates and mortgages in the UK?

Inflation, interest rates, and mortgages are interconnected elements of the economic landscape, each exerting influence on the others. Changes in inflation can have significant repercussions on interest rates and subsequently impact mortgage borrowers and the housing...

Non-dom tax implications

Tim Crook, our Head of Private Clients at OCG Legal, takes a look at the Spring Budget in detail. Non-Dom Tax Regime The Chancellor announced the abolition of the non-dom tax regime and provided some detail on the new system that would replace it from April 2025....

Multiple Dwellings Relief – Spring Budget

Hayley Blackett, Conveyancing Team Leader at OCG Legal, takes a look at the implications of MDR abolishment Multiple Dwellings Relief Abolished – Budget 2024 What is Multiple Dwellings Relief (MDR)? MDR applies to the purchase of two or more dwellings in a single...

What are the implications on Inheritance Tax in tomorrow’s budget?

As anticipation mounts for the UK Spring Budget, one area of interest for many individuals is potential changes to inheritance tax (IHT) laws. In recent years, IHT has been a subject of much debate and speculation, with calls for reforms echoing throughout the...

Empowering your future – The importance of creating a Lasting Power of Attorney

Life is unpredictable, and unforeseen circumstances can arise at any moment. While we may not have control over everything, creating a Lasting Power of Attorney (LPA) is a proactive and prudent step towards securing our future. In this blog, we'll explore the crucial...

Transforming Conveyancing: The Role of AI in Revolutionising Conveyancing Firms

Title: Transforming Conveyancing: The Role of AI in Revolutionizing Conveyancing Firms Introduction The legal landscape is evolving, and with it, the role of technology in the legal profession is becoming increasingly prominent. In the realm of conveyancing, the...

Will Gen X pay off their mortgages?

Freedom at Last: How Generation X is Triumphantly Paying Off Their Mortgages For Generation X, born roughly between the mid-1960s and early 1980s, the journey to financial freedom has been marked by hard work, resilience, and adaptability. As this generation enters a...